November 6, 2025 – Nvidia closed at $4.02 tn market cap today, surpassing Apple and becoming the world’s most valuable company as hyperscalers commit $250 bn to AI capex in 2026.

The $4 Trillion Trigger

Q3 Results (reported after close)

- Revenue $35.1 bn (+94% YoY)

- Data Center $30.8 bn (+112%)

- Gross margin 75.1%

- EPS $0.81 (beat by $0.07)

2026 Guidance

- Q4 revenue $43 bn (street $41 bn)

- FY2026 revenue $210 bn implied (+67% YoY)

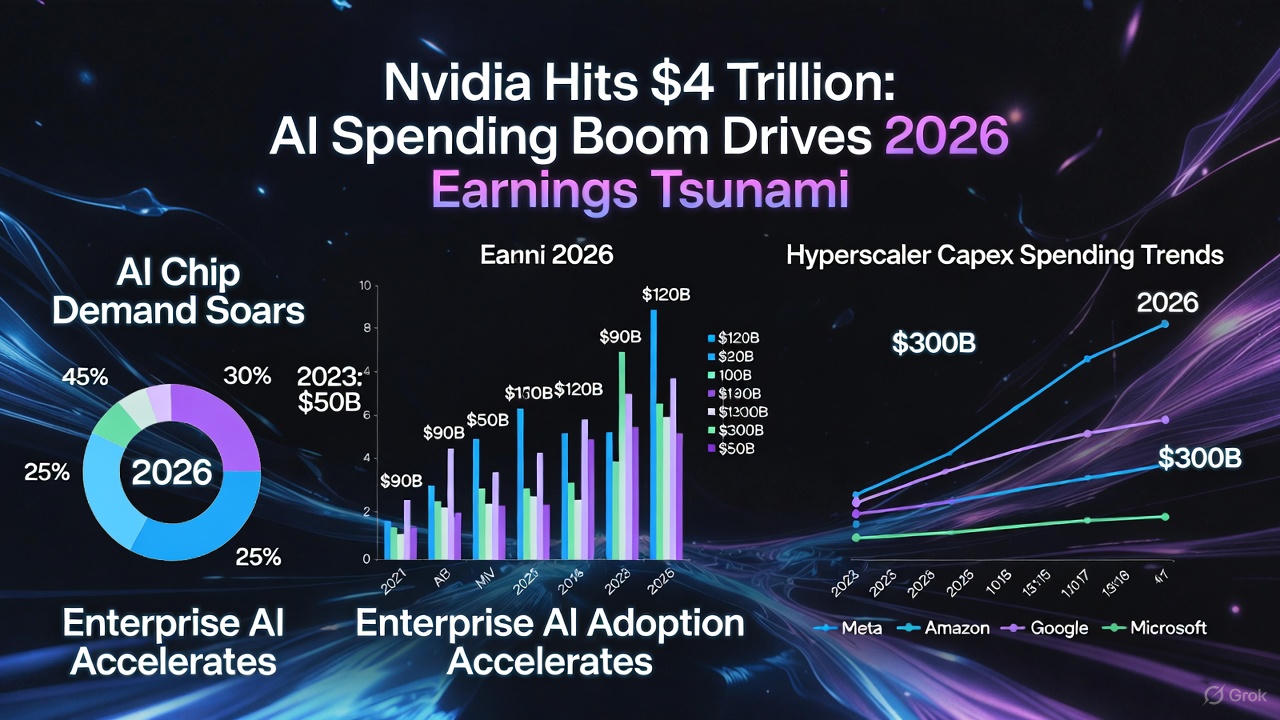

Hyperscaler Capex Explosion

| Company | 2026 AI Capex | vs 2025 |

|---|---|---|

| Meta | $65 bn | +62% |

| Amazon | $100 bn | +33% |

| $75 bn | +50% | |

| Microsoft | $80 bn | +45% |

Total Big-4 AI spend 2026: $320 bn → 80% flows to Nvidia/TSMC/Broadcom.

Supply Chain Winners

| Stock | Gain Today | 2026 Target |

|---|---|---|

| NVDA | +4.2% | $180 |

| TSM | +6.8% | $280 |

| AVGO | +5.1% | $320 |

| ASML | +7.3% | €1,200 |

| SMCI | +18% | $180 |

Investment Strategies

Core AI Basket (30% portfolio)

NVDA 40% / AVGO 20% / TSM 20% / AMD 10% / ARM 10%

Rebalance quarterly.

Options Alpha

- NVDA Jan 2027 $200 calls (delta 0.35) – 400% implied move priced

- Sell NVDA weekly puts below $130 for 2.5% monthly yield

Short-Term Trade

Long SMCI $65 → $120 gap fill by December OPEX.

Hedge

10% TLT + gold miners if Fed pauses cuts.

Risks

- China export curbs on advanced chips

- Blackwell yield issues delay H2 ramp

- 40% drawdown every 18 months (historical)

Bottom line: AI capex inflection just started. $5 tn Nvidia by July 2026 is consensus. Buy every dip.