Global markets offer endless opportunities for wealth growth, from Wall Street giants to emerging Asian tech. With apps like eToro or Interactive Brokers accessible worldwide, anyone can start with $100. This guide covers core assets, strategies, diversification, and risk management for long-term success.

Key Asset Classes

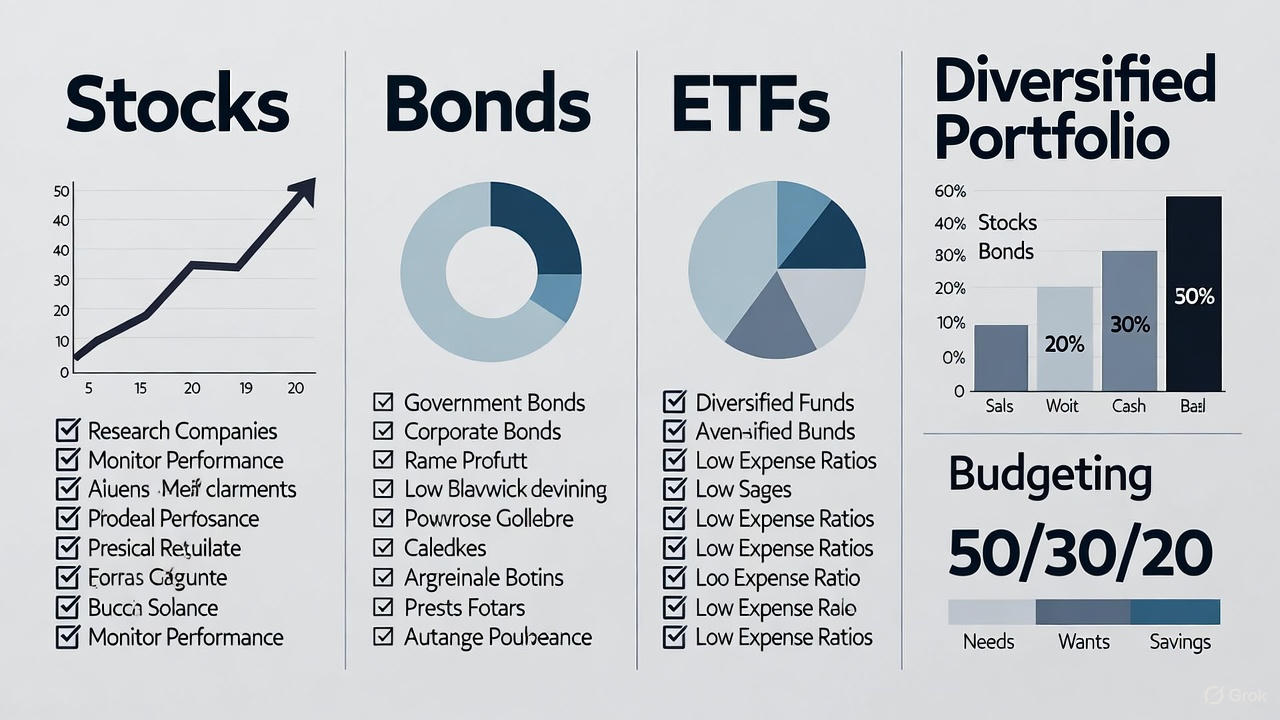

- Stocks: Ownership in companies. Growth via price appreciation/dividends. S&P 500 averages 10% annual returns historically.

- Bonds: Loans to governments/corporates. Fixed income, lower risk. US Treasuries yield 4-5%; corporates higher.

- ETFs/Mutual Funds: Baskets of assets. SPY (S&P 500 ETF) for US exposure; VXUS for international.

- Commodities: Gold (inflation hedge), oil.

- Crypto: Bitcoin/ETH—high volatility, 100%+ gains possible but crashes common.

- Real Estate: REITs like VNQ for passive property income.

Start with index funds—beat 80% active managers over 10 years.

Proven Strategies

- Buy and Hold: Warren Buffett style. Apple stock: $1 in 2000 → $500+ today adjusted.

- Dollar-Cost Averaging: Invest fixed amounts monthly. Mitigates volatility—buy more shares when low.

- Value vs Growth: Value (undervalued P/E <15); Growth (Tesla-like innovators).

- Dividend Aristocrats: Coca-Cola, Procter & Gamble—25+ years increasing payouts.

Use Robinhood, Fidelity, or Vanguard—zero commissions.

Diversification Rules

- 60/40 Portfolio: 60% stocks, 40% bonds. Balances growth/stability.

- Geographic: 50% US, 30% Europe/Asia, 20% emerging (India, Brazil).

- Sectors: Tech, healthcare, consumer, energy—no more than 20% one area.

- Rebalance annually: Sell winners, buy laggards.

Example: $10,000 portfolio—$4,000 VTI (US total), $3,000 VXUS (intl), $2,000 BND (bonds), $1,000 GLD.

Risk Management

- Emergency Fund First: 3-6 months cash.

- Asset Allocation by Age: 20s: 90% stocks; 50s: 60%.

- Stop-Loss Orders: Limit downside 10-15%.

- Understand Volatility: VIX >30 signals fear—buy dips.

- Taxes: Use Roth IRA (US) or tax-advantaged accounts; harvest losses.

Inflation at 3% erodes cash—invest to outpace.

Compounding Power

$500/month at 8% from age 25: $1.3 million by 65. Delay to 35: $550,000. Time is key.

Avoid: Timing market, leverage without experience, FOMO into memes.

Global investing democratizes wealth. Research via Yahoo Finance, Morningstar. Start small, learn, compound.