The Power of Compound Interest: How Small Investments Grow into Fortunes Over Time

Compound interest is often called the “eighth wonder of the world” by Albert Einstein, and for good reason—it turns modest, consistent savings into substantial wealth through the magic of earnings on earnings. Unlike simple interest, which only applies to the principal, compound interest calculates returns on both the initial amount and accumulated interest, creating exponential growth. This article explores the mechanics of compounding, real-world examples, strategies to maximize it, common pitfalls, and how anyone can harness it for financial independence, regardless of starting point.

Understanding the Compound Interest Formula

The core equation is A = P(1 + r/n)^(nt), where:

- A = final amount

- P = principal (initial investment)

- r = annual interest rate (decimal)

- n = compounding frequency per year

- t = time in years

For example, invest $1,000 at 7% annually, compounded monthly (n=12) for 30 years: A = 1000(1 + 0.07/12)^(12*30) ≈ $7,612. That’s over 7x growth without adding more money.

Frequency matters: Daily compounding yields slightly more than annual. A $10,000 deposit at 5% over 20 years:

- Annually: ~$26,533

- Monthly: ~$27,126

- Daily: ~$27,183

Banks and investments compound quarterly or continuously for max effect (using e^rt for continuous).

Historical Proof: Long-Term Market Returns

Stock markets exemplify compounding. The S&P 500 has averaged ~10% annual returns (including dividends) since 1926. Invest $5,000 yearly from age 25 at 10%:

- By 65 (40 years): ~$2.66 million

- Start at 35 (30 years): ~$886,000

Vanguard’s data shows $100/month in an S&P 500 index fund from 1980-2023 grew to over $500,000. Inflation-adjusted, still beats cash.

Warren Buffett’s Berkshire Hathaway: $10,000 in 1965 → $300+ million today, ~20% compounded annually. Key: Reinvest dividends, avoid withdrawals.

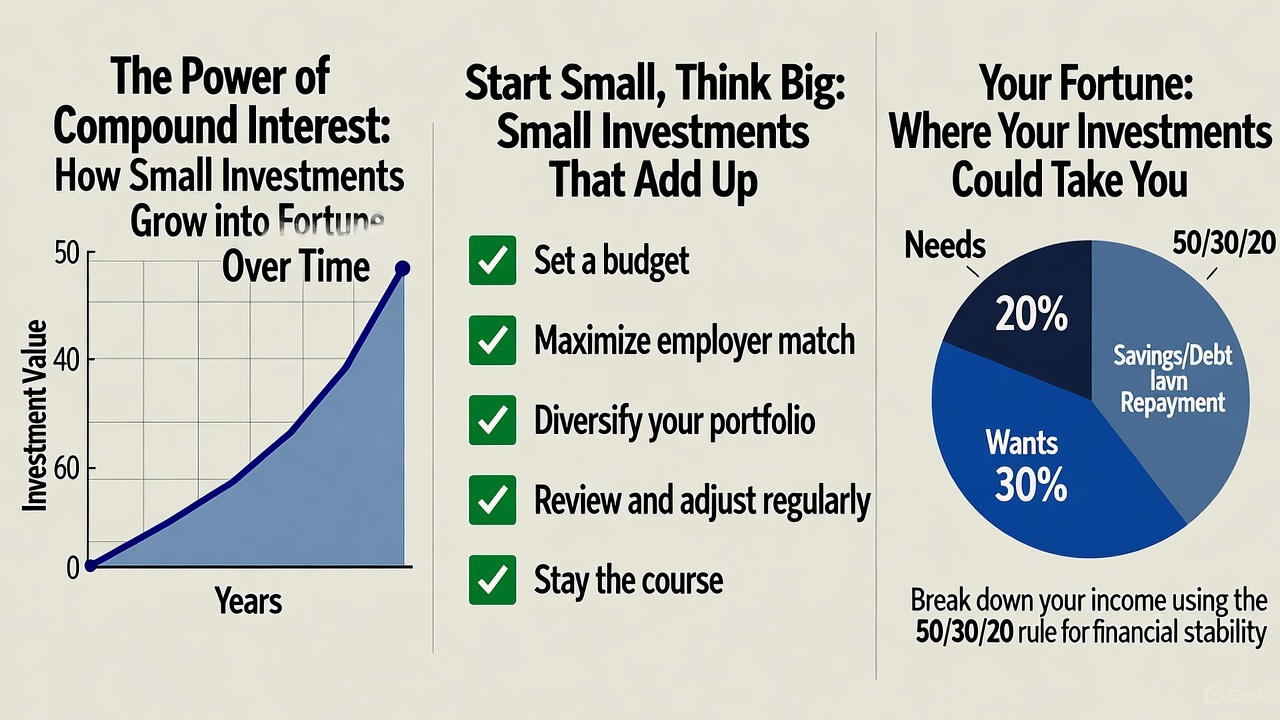

Strategies to Supercharge Compounding

- Start Early: Time is the biggest multiplier. A 20-year-old investing $200/month at 8% until 65 gets ~$1.5 million. Wait until 40: ~$300,000 for same contributions.

- Increase Contributions: Raise with income. 401(k)/IRA matches are free money—max employer contributions (up to $23,000 US 2025).

- Choose High-Return Assets:

- Stocks/ETFs: 7-10% long-term (Vanguard Total World Stock ETF).

- Real Estate: Rental yields + appreciation (5-8% net).

- Peer-to-Peer Lending: 6-12% via platforms like LendingClub.

- Reinvest Everything: Dividends, interest—let them buy more shares. DRIPs (Dividend Reinvestment Plans) automate this.

- Tax-Advantaged Accounts: Roth IRA (tax-free growth), HSA (triple tax benefits). In UK: ISAs; Australia: Superannuation.

- Automate: Set payroll deductions. Apps like Acorns round up purchases to invest spares.

Real example: Starbucks barista invests $50/week in index funds from 22. At 7% over 45 years: ~$700,000+.

Common Pitfalls and How to Avoid Them

- Inflation Erosion: 3% average eats returns. Target 4%+ net (investments minus inflation).

- Fees: 1% annual fee reduces 30-year growth by 25%. Choose low-cost index funds (0.04% expense ratio).

- Withdrawals: Early dips kill momentum. Rule: Only invest what you won’t need for 5+ years.

- Chasing Highs: 15%+ returns often mean high risk (crypto crashes 80%). Stick to diversified 7-10%.

- Debt Interference: Pay 18% credit cards before 7% investments—net loss otherwise.

Behavioral finance: Markets crash 10-20% every few years (2008: -50%, 2020: -34%). Hold through; recoveries compound higher.

Advanced Tactics for Seasoned Investors

- Leveraged Compounding: Margin cautiously (e.g., 2:1 on stable ETFs), but risks amplification.

- Options for Income: Covered calls on stocks generate 2-5% extra yield.

- Multi-Asset Allocation: 70/20/10 stocks/bonds/alternatives rebalanced yearly.

- Monte Carlo Simulations: Tools like Portfolio Visualizer forecast probabilities (90% chance of $1M+).

For retirees: Shift to 4% withdrawal rule on compounded nest egg sustains 30+ years.

Real-Life Success Stories

- Ronald Read, janitor: $8 million estate from compounding blue-chip stocks over decades.

- Grace Groner: $180 secret to $7 million via Abbott shares bought in 1935.

Anyone can replicate: Live below means, invest difference.

Compound interest rewards patience and discipline. Calculate your path with online calculators (Investor.gov). Start today—$100/month at 8% for 40 years: ~$300,000. Delay compounds against you. Build habits, watch wealth snowball.

In a world of get-rich-quick schemes, compounding is the proven, quiet path to millions. Educate, invest consistently, and let time do the heavy lifting.